To continue, please visit our partner site:

Remote DepositTo continue, please visit our partner site:

TranslinkTo continue, please visit our partner site:

eZ BusinessTo continue, please visit our partner site:

Trust ReporterTo continue, please visit our partner site:

CeteraTo continue, please visit our partner site:

TransportTo continue, please visit our partner site:

LockboxTo continue, please visit our partner site:

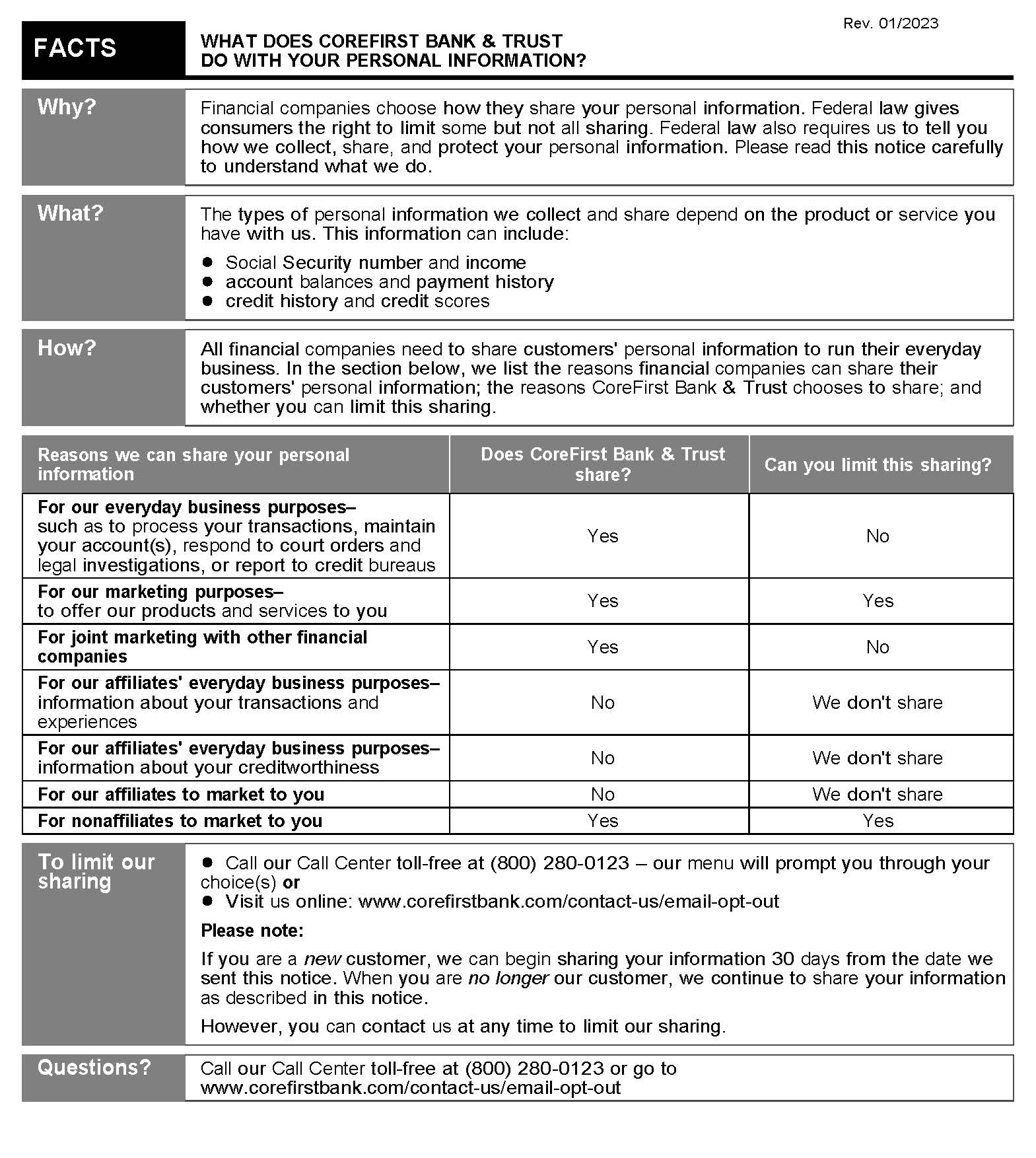

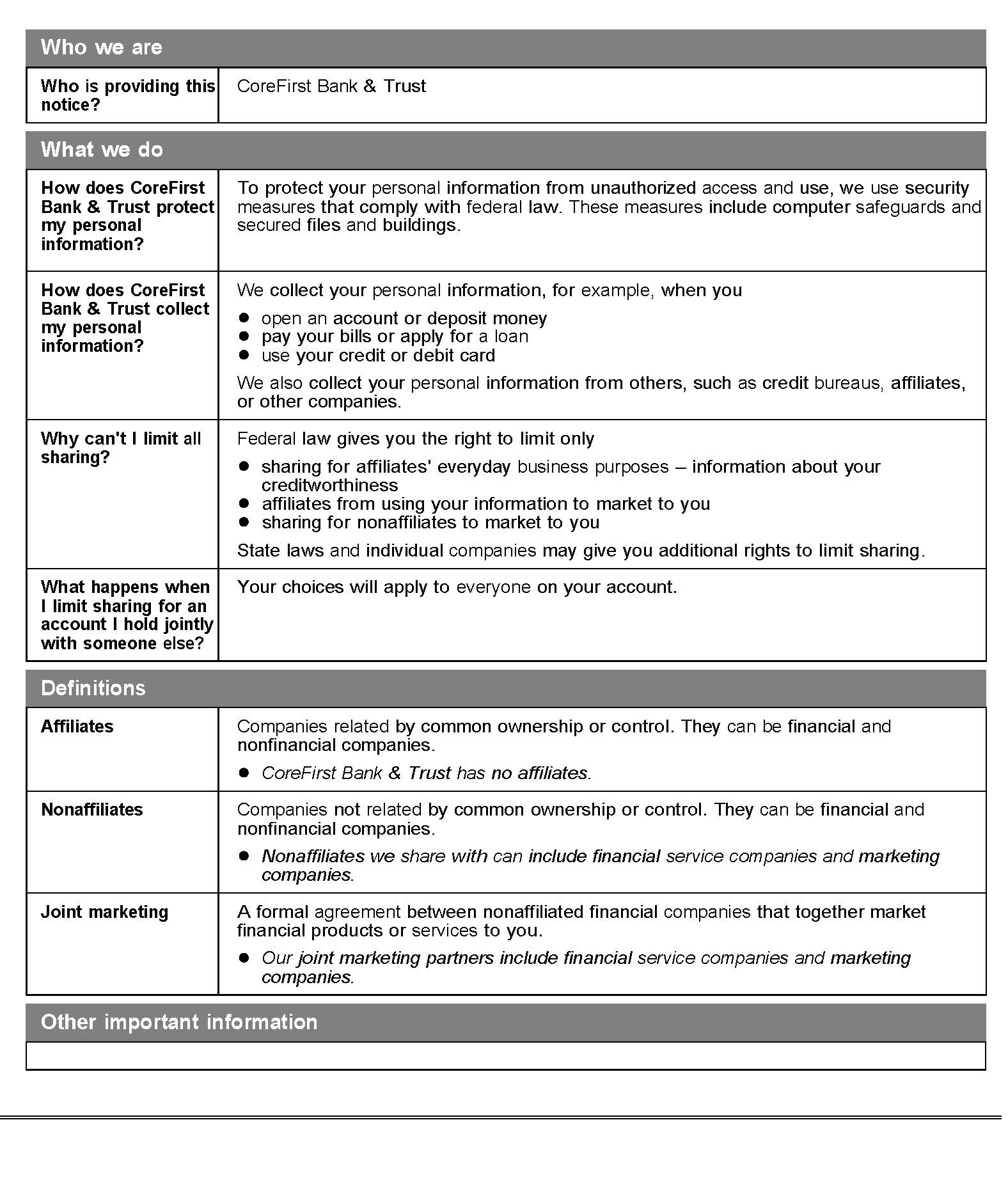

ScoreCard® RewardsPrivacy Policy

CoreFirst Bank & Trust is committed to protecting your financial privacy. We understand that you may have some questions about how and why CoreFirst Bank & Trust collects, uses and protects information. Some frequently asked questions are listed below:

Privacy Questions and Answers

-

No. CoreFirst Bank & Trust has not and will not sell information to outside companies.

-

Yes, but just for business purposes. We use outside vendors to help us maintain your account by doing such things as printing checks, processing account transactions, providing technological assistance and helping us offer products and services tailored to fit your financial needs. By using outside vendors, we can keep our costs down and operate more efficiently.

-

We have strict internal policies against unauthorized use or disclosure of customer information. Customer information is accessed only by employees who need it to conduct your financial affairs.

-

Boost your Credit Score with These Tips

Follow these tips to build a healthy credit history! -

Security Alert: Virtual Kidnapping Scam

Receiving a fake ransom call is scary – but it’s important not to panic! Here’s what to do if you receive a call from someone claiming to hold your family member for ransom. -

Credit Freeze vs. Fraud Alert: Know the Difference

Fraud alerts and credit freezes can be used to keep identity thieves from opening new credit in your name. But what’s the difference? Learn more here!

-

To Rent or to Buy? We Can Help You Decide!

For many renters, owning a home is the ultimate goal. But it’s not always easy to know if that’s the right move for you. If you’re stuck between renting or owning, here are a few tips to help you make your decision. -

First Home? Renting or Buying Ask Yourself These Questions First.

Before your start looking for a home of your own, make sure you are ready financially. -

Boost Your Credit Score

Applying for credit? Make sure you know the basics on building your credit score.

-

Buying a Used Car? Here’s What to Look For.

If you’ve been waiting and are now ready to look for an affordable but quality used car, here are some things you should do first! -

Be Confident in your New Car!

With a little research and preparation, you can feel confident behind the wheel of your new automobile! Follow these tips to take the stress out of car shopping. -

Should I Lease or Buy My Next Vehicle?

Lease or Buy? Check out this checklist before deciding how to finance your next vehicle.

-

Budgeting 101: A Beginner’s Guide

Budgeting isn't as intimidating as you might think! Check out this beginner's guide to building your first budget. -

Tomorrow’s Millionaire: Invest Early

If you want to be a millionaire someday, you’ll need to start investing your money ASAP! Check out these tips for young, first-time investors. -

Thanksgiving On A Budget

Don't let high grocery prices ruin your Thanksgiving with these cost-saving tips.